by Diego ColmanContributing Strategist

The U.S. dollar rallied vigorously on Wednesday, fueled by hotter-than-expected U.S. inflation numbers. This upswing propelled USD/JPY to fresh 2024 highs and to its strongest level since 1990. For context, the March Consumer Price Index report revealed a persistent inflationary environment in the North American economy, diminishing hopes for a June FOMC rate cut.

Focusing on today’s data, headline CPI climbed 3.5% year-over-year, exceeding forecasts and accelerating from February’s 3.2% reading. The core gauge, which strips out volatile energy and food costs, also surprised on the upside, clocking in at 3.8% versus the expected 3.7% – a sign that price pressures may be regaining momentum.

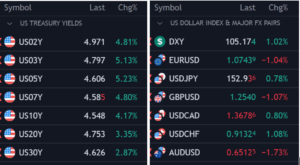

Wall Street reacted swiftly, pushing U.S. Treasury yields upwards across the board on bets that the Federal Reserve may be compelled to maintain a restrictive position for an extended period. Against this backdrop, the U.S. 2-year yield jumped more than 20 basis points, coming within striking distance from recapturing the 5.0% psychological mark.

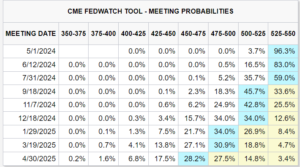

Traders also adjusted their view on the FOMC’s trajectory, pushing back on the timing and magnitude of future reductions in borrowing costs. That said, futures contracts now price in less than 40 basis points of easing for the year, with the first potential cut likely occurring in September. The table below shows current meeting probabilities.

Earlier this month, Fed Chair Powell downplayed concerns about inflation during a speech at the Stanford Business, Government, and Society Forum. However, three consecutive months of hotter-than-expected CPI figures may prompt a reassessment of the policy outlook. This could potentially lead to more hawkish rhetoric in the upcoming days and weeks – a bullish outcome for the U.S. dollar.

While the greenback may consolidate to the upside in the near term, it is uncertain whether it can continue to appreciate relentlessly against the yen, as Japanese authorities may soon step in to support the domestic currency, with USD/JPY trading at levels not seen in nearly 34 years.

USD/JPY TECHNICAL ANALYSIS

USD/JPY blasted past resistance at 152.00 on Wednesday, hitting its strongest mark since June 1990. If Tokyo doesn’t ramp up verbal intervention or move in quickly to contain the yen’s decline, speculators may feel emboldened to initiate an attack on the upper boundary of a medium-term ascending channel located near 155.70.

On the flip side, if prices turn lower and head back below 152.00, a possible support area emerges at 150.90. Bulls are likely to vigorously defend this area; failure to do so could spark a retracement towards the 50-day simple moving average at 150.00. Below this threshold, all eyes will be on channel support near 149.25.

USD/JPY PRICE ACTION CHART