By Akhtar Faruqui

- The Australian Dollar rebounds due to possible risk-on sentiment.

- The Australian Industry Index indicated prevailing contractionary conditions for the past twenty-four months.

- Following recent reports suggesting Tokyo’s involvement in the currency market, traders will monitor for any Japanese intervention.

AUD/JPY snaps its two-day losing streak, possibly due to the improved risk appetite, hovering around 102.20. However, the Australian Dollar (AUD) faced pressure in Asian hours following the release of the AiG Industry Index on Wednesday, a leading indicator measuring private business activity in Australia, which continued its decline in March.

The softer Aussie Retail Sales released on Tuesday could potentially impact the Reserve Bank of Australia’s (RBA) hawkish stance on interest rate trajectory. However, higher-than-expected domestic inflation data released last week raised expectations that the RBA may delay interest rate cuts. The central bank is scheduled to meet next week, and it is widely anticipated to maintain interest rates at the current level of 4.35%.

In Japan, market participants are closely monitoring for potential intervention following reports of Tokyo’s involvement in the currency market on Monday, which boosted the Japanese Yen (JPY), according to Reuters. Additionally, expectations for a sustained significant interest rate differential between Japan and other nations suggest that the trajectory of the JPY is biased toward further depreciation.

The Bank of Japan (BoJ) is set to release its Monetary Policy Meeting Minutes on Thursday. These minutes provide insight into economic developments in Japan following the actual meeting. Changes in this report can influence JPY volatility.

Daily Digest Market Movers: AUD/JPY appreciates due to possible risk-on sentiment

- According to Reuters, the Sankei newspaper reported on Tuesday that Japan is considering implementing tax breaks for repatriation of corporate profits into the Yen. This measure may potentially be included in the annual mid-year policy blueprint.

- In April, the AiG Australian Industry Index declined by 3.6 points to reach -8.9 points, indicating prevailing contractionary conditions for the past twenty-four months. The previous reading was -5.3 in March.

- The benchmark ASX 200 opened lower on Wednesday, with all 11 sectors in the red. This decline followed hot US labor data that unsettled Wall Street, sparking concerns that persistent inflation may prompt the US Federal Reserve (Fed) to maintain higher interest rates for an extended period.

- As reported by the Financial Review, ANZ anticipates that the RBA will commence cutting interest rates in November, following last week’s stronger-than-expected inflation data. In a similar vein, Australia’s largest mortgage lender, Commonwealth Bank, has adjusted its forecast for the timing of the first interest rate cut by the RBA. They are now projecting only one cut in November.

- The seasonally adjusted Australian Retail Sales released on Tuesday showed a drop in March, compared to the expected increase and the previous growth.

- Japan’s Retail Trade increased by 1.2% year-over-year in March, which was lower than the expected increase of 2.5% and the previous increase of 4.7%. The seasonally adjusted Retail Trade (MoM) decreased by 1.2%, against the expected rise of 0.6%.

- Masato Kanda, Japan’s senior currency diplomat, made pointed comments regarding the currency’s impact on import prices, emphasizing its significant influence. He highlighted the readiness of authorities to take action around the clock to address currency-related matters, as per a Reuters report.

- BoJ Governor Kazuo Ueda provided insights into the central bank’s decision to maintain the status quo during the post-policy meeting press conference on Friday. Ueda outlined that the BoJ will adjust the degree of monetary easing if the underlying inflation rate rises.

Technical Analysis: AUD/JPY hovers around the psychological level of 102.00

The AUD/JPY traded around 102.10 on Wednesday, breaking below the lower boundary of a rising wedge pattern on the daily chart, which typically indicates a bearish reversal. This decline could weaken bullish sentiment; however, traders may await confirmation from the 14-day Relative Strength Index (RSI), which is still above the 50-level.

Immediate resistance is observed at the lower boundary of the wedge around the psychological level of 103.00. A rebound back into the ascending wedge could potentially improve the bullish sentiment and push the AUD/JPY pair toward the psychological level of 105.00, coinciding with the upper boundary of the wedge.

On the downside, immediate support for the AUD/JPY pair is seen at the psychological level of 102.00, followed by the nine-day Exponential Moving Average (EMA) at 101.56.

AUD/JPY: Daily Chart

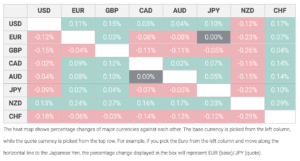

Japanese Yen price today

The table below shows the percentage change of the Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the weakest against the New Zealand Dollar.