by Diego ColmanContributing Strategist

Following a brief surge in geopolitical tensions, traders may find relief in Iran’s decision not to further retaliate against Israel’s countermove, signaling a potential de-escalation in the Middle East and a return to focus on fundamental market drivers.

ECONOMIC DATA IN THE SPOTLIGHT

The upcoming week promises significant economic data releases that could sway market sentiment. Of particular interest are the US GDP for the first quarter and March’s core PCE data, a key inflation indicator for the Fed. Recent strong figures in retail sales, CPI, and PPI suggest that these reports could potentially exceed expectations.

Should the data prove hotter than anticipated, investors might conclude that the US economy remains resilient, and inflation is proving stubbornly persistent. This scenario could prompt a repricing of expectations, with traders betting on the Fed maintaining higher interest rates for longer and a shallower easing cycle than previously thought – a bullish outcome for U.S. yields and the U.S. dollar.

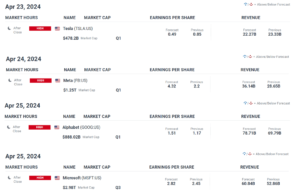

EARNINGS SEASON HEATS UP

First-quarter earnings season marches on, with major tech companies slated to report their results. Tesla, Meta, Alphabet, Amazon, and Microsoft will offer insights into the corporate landscape. Strong earnings could lift market sentiment and bolster major indices, while disappointing results could raise concerns about economic challenges ahead.

CENTRAL BANK WATCH: EYES ON THE BOJ

Central banks continue to command attention, with the Bank of Japan’s policy decision in the spotlight. Traders will closely analyze guidance for clues on the BoJ’s stance on rate hikes. If the bank indicates a lack of urgency for further increases, pressure on the Japanese yen could intensify. However, given the yen’s recent decline, the BoJ might adopt a slightly more hawkish stance to counteract currency weakness.

KEY TAKEAWAYS

This week promises to be action-packed as traders navigate a mix of geopolitical developments, pivotal economic data releases, earnings reports, and central bank communications. Staying informed about these events will be crucial for traders looking to capitalize on market movements and manage their risk exposure.