By Akhtar Faruqui

- AUD/JPY consolidates with a positive sentiment due to the eased geopolitical tensions in the Middle East.

- Australia’s Judo Bank Composite PMI indicated a rapid expansion in the Australian private sector during Q2.

- The Japanese Yen encounters challenges as the yield gap widens between Japan and other major countries.

AUD/JPY maintains stability on Tuesday following gains in the previous session. The prevailing optimistic mood may lend support to the Australian Dollar (AUD), underpinning the AUD/JPY cross, potentially influenced by a relaxed geopolitical climate in the Middle East.

Australia’s Judo Bank Composite Purchasing Managers Index (PMI) surged to a 24-month high of 53.6 in April, marking an improvement from the previous month’s 53.3. This signals an accelerated expansion in the Australian private sector during the second quarter, with notable growth driven by the services sector.

The Japanese Yen (JPY) faces challenges due to the expanding yield gap between Japan and many other major countries, prompting traders to borrow JPY and invest in higher-yielding assets elsewhere.

Additionally, dovish comments from Bank of Japan (BoJ) Governor Kazuo Ueda on Friday added to the pressure on the Yen. According to Reuters, Ueda emphasized the necessity for the BoJ to maintain accommodative monetary policies in the foreseeable future due to underlying inflation remaining “somewhat below” the 2% target.

Daily Digest Market Movers: AUD/JPY consolidates with an improved risk sentiment

- Australia’s Judo Bank Manufacturing PMI rose to an eight-month high of 49.9 in April, compared to March’s 47.3. Services PMI declined to a 2-month low of 54.2 compared to the previous reading of 54.4.

- The weekly ANZ-Roy Morgan Australian Consumer Confidence declined by 3.2 points to reach its lowest level this year at 80.3, down from the previous reading of 83.5. ANZ noted that both economic and financial subindices experienced decreases. Confidence dropped across various housing cohorts, with renters being particularly affected.

- Japan’s Jibun Bank Manufacturing PMI improved to 49.9 in April, compared to the expected reading of 48.0 and 48.2 prior. Meanwhile, Services PMI rose to 54.6 from the previous reading of 54.1.

- On Tuesday, the China Securities Journal reported that there remains a possibility that the People’s Bank of China (PBoC) will decrease the Medium-term Lending Facility (MLF) rate, aiming to lower funding costs. The next MLF rate setting is scheduled for May 15. This decision could potentially influence the Australian market, given the close trade relationship between the two countries.

- The People’s Bank of China maintained its Loan Prime Rates (LPR) at 3.45% on Monday. The LPR functions as a benchmark rate for Chinese banks in setting interest rates for loans extended to their clients.

- On Monday, the Chinese Ministry of Commerce announced a new tariff on US goods. Specifically, China has imposed a duty of 43.5% on imports of propionic acid from the United States. This chemical is extensively utilized in various sectors, including food, feed, pesticides, and medical applications, as per Reuters report.

- According to a Westpac report, while the RBA signaled that rates are unlikely to be raised further, greater confidence in the inflation outlook is required before contemplating the possibility of rate cuts.

- Traders are expected to closely monitor the upcoming Monthly Consumer Price Index and quarterly RBA Trimmed Mean CPI data from Australia on Wednesday.

Technical Analysis: AUD/JPY holds position around the level of 100.00

The AUD/JPY trades around 99.90 on Tuesday. The cross remains above the significant support level of 99.65, coupled with the 14-day Relative Strength Index (RSI) persisting above the 50 level, indicating an evolving bullish sentiment. The immediate barrier appears at the psychological level of 100.00, following the major level of 100.50 and April’s high of 100.81. A break above this region could lead the AUD/JPY cross to test the upper boundary of the ascending channel.

On the downside, the AUD/JPY cross could find immediate support at the psychological level of 99.50. A break below this level could lead the pair to approach the psychological level of 99.00. A break below this level could push the pair to test the lower boundary of the ascending channel and a major level of 98.50.

AUD/JPY: Daily Chart

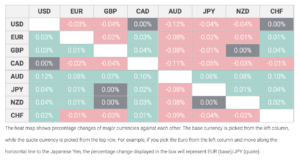

Australian Dollar price today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the US Dollar.