by Nick CawleySenior Strategist

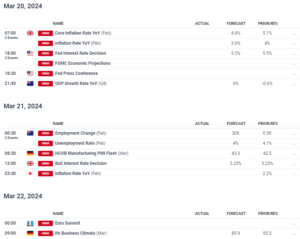

The economic data and central bank calendars are packed full next week with a range of potentially market-moving releases. Five central banks will announce their latest monetary policy decisions, with the Bank of Japan the most interesting. Markets currently see a 40% chance that the BoJ will hike rates by 10 basis points as the latest Japanese wage negotiations show large hikes to workers’ pay across various industries.

Along with the central bank announcements, there are important data releases throughout the week with UK inflation, German Manufacturing PMIs, and Euro Area sentiment PMIs the standouts.

MARKETS OVERVIEW – GOLD, NASDAQ, NVIDIA, MICROSTRATEGY

Gold has been under pressure this week due to the US dollars rebound, although the precious metal remains near a multi-decade high. Technical analysts will be closely watching a Bullish Pennant formation that is nearly complete. The next few days will see if this pattern plays out.

GOLD DAILY PRICE CHART

The Nasdaq ended the week lower and is starting to fall out of a multi-month ascending trend. The tech bellwether is also showing signs of topping out and unless Fed Chair Powell turns dovish at the FOMC meeting on Wednesday, the Nasdaq may continue to struggle.

NASDAQ 100 DAILY PRICE CHART

One of the largest companies in the Nasdaq, Nvidia, is also struggling. The chip giant balked at just under the $1,000 level on March 8th and despite a couple of short-term rallies, Nvidia ended lower on the week.

NVIDIA (NVDA) DAILY PRICE CHART

MicroStrategy has been rallying hard in recent weeks, on the back of heavy ETF demand for Bitcoin. MicroStrategy holds in excess of 200,000 Bitcoin on its books and continues to buy BTC on a regular basis. MSTR posted a fresh high again on Friday, despite Bitcoin selling off with talk that a short-squeeze may be happening after traders piled in on the short MSTR/long BTC arbitrage. These positions are underwater and traders’ losses are mounting up.

MICROSTRATEGY (MSTR) DAILY PRICE CHART