by Nick CawleySenior Strategist

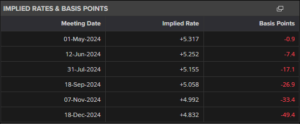

US interest rate cut expectations continue to be pushed back into Q3 after the latest US CPI report showed inflation refusing to move lower. A rate cut at the June FOMC meeting looks highly unlikely, while a move at the July meeting is only partially priced in. Markets are also predicting just two 25-basis point rate cuts this year. This re-pricing has seen the US dollar rally sharply, while US Treasury yields hit multi-month highs.

US DOLLAR INDEX DAILY CHART

Despite this higher-for-longer US rate backdrop, gold continued to print new all-time highs before a sharp, intra-day sell-off late Friday. Gold posted a new ATH at $2,431/oz. before giving back around $90/oz. to end the week at $2,343/oz. Silver also had a very volatile session Friday, making a high of $29.79/oz. before ending the session at $27.84/oz.

SILVER DAILY PRICE CHART

The US dollar’s renewed strength was seen across many USD pairs, with both EUR/USD and GBP/USD hitting five-month lows on Friday.

Next week’s economic calendar has a range of high-importance data releases and events from several countries, with US retail sales, UK inflation and labor data, and German And Euro Area ZEW readings the standouts.

CHART OF THE WEEK – APPLE

Apple turned sharply higher Thursday after closing in on the late-October low, after news hit the screens that the company said that it would update its Mac Book line with the new M3 chip. Apple is now closing back in on an old area of support turned resistance around $179.